Real Estate Investment Operating Partner

in Spain

IREMCAP is a fully independent company specialized in real estate asset and investment management in Spain.

about us

We operate on behalf and for private / institutional investors.

Based on more than 40 years of combined experience in banking and real estate, our expertise aims at securing investment for our clients and performing property and asset management through a bespoke and transparent full-fledged

service.

Extensive network of local providers.

Our unique access to an extensive network of local providers, business contacts and sourcing abilities in the market makes us an ideal partner for midmarket capital investors looking to diversify their allocations in Spain.

OBJECTIVES

Our activity is organized around two main objectives:

- An independent consulting company, managing real estate investments for institutional and private clients to support their acquisitions in Spain.

- An investment structure that can co-invest together with institutional or private investors, through specific dedicated funds or club deals, ensuring alignment of interests.

services

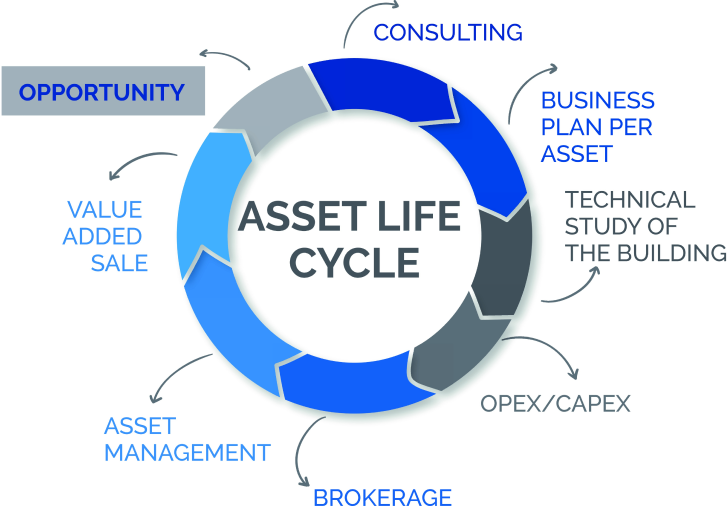

We understand our global mission as the succession of the following steps:

Define the acquisition strategy aligned with tax/investment structure of each client

Sourcing opportunities

Assets presentation after first analysis

Analysis and management of the acquisition process

Property management of the assets once integrated into their respective vehicles

Analysis of opportunities for improvement and optimization of assets to create value

Open sale process of the assets once decided their placing on the market

Our process

INVESTMENT PHASE

INVESTMENT PHASE

- Search for opportunities in the Spanish market;

- Analysis of different opportunities with the client;

- Negotiating opportunities selected by the client;

- Bank term sheets to enhance return on investment through leverage;

- Supervision of the due diligence process with lawyers and technical advisors;

- Closing acquisitions.

ASSET / PROPERTY MANAGEMENT PHASE

ASSET / PROPERTY MANAGEMENT PHASE

- Management of all the documents database;

- Change of tenancy (administrative process);

- Elaboration of billings (rent, indexation and recoverable charges);

- Annual budget definition;

- Supervision of CAPEX if needed to be done;

- Management of problems and disputes with tenants;

- Preparation of reports at the request of the client;

- Support valuations process with experts;

- Marketing strategy, letting supervision/negotiation;

- Bring value through the whole tenancy phase by constantly finding ways to actively manage the asset.

DIVESTMENT PHASE OF THE ASSETS

DIVESTMENT PHASE OF THE ASSETS

- Sales recommendations based on the business plans of each property according to the dynamics of the real estate market;

- Ongoing assessment of the most aggressive historical players and investors on the market;

- Search for potential acquiring tenants (if empty);

- Organization of the data room for sale;

- Sale process execution.

Strategy

Depending on the client requirements we can look at opportunities from Core to Opportunistic with a major expertise on income-based investments, especially on Sale&Lease Back acquisition processes. In terms of asset class our preferred

are the followings:

- Value Add Residential

- Offices

- Education

- Light industrial

- Retail Park / High street retail

- Healthcare

- Logistic

Impact Investing

We have developed a specific expertise in developing strategies for real estate impact investments through our fully owned subsidiary THEGIGWAY. Check out on

www.thegigway.com. Following our objective to make an impact also on a corporate level we partner with Noos Global with a monthly commitment in favor of forestation around the world.

Our Team

Guillaume Sainpy

Founder

Guillaume Sainpy

founder

Experience

- More than 18 years of experience in the real estate investment sector.

- Specialized in light industrial / logistic and income-based assets.

- Experience in structuring investment operations for private and / or institutional (REIT) – 6 years

- Former Director of Investments and Corporate Accounts at AOS Studley (today Colliers), Spain – 5 years

- Managed different exclusive mandate for clients such as DHL, Salvesen Logistics, Saint-Gobain, Oracle, Atos Origin and worked with many investment funds (Carlyle…).

- Certificate in Hotel Investment & Asset Management by Cornell University (USA)

- Member of RICS (Royal Institution of Chartered Surveyors) – 8 years

- Member of ULI Next (Urban Land Institute) – 3 years

- MBA from the University of Deusto, Spain

Ricardo Werth

Partner

Ricardo Werth

partner

Experience

- More than 25 years of experience in the financial sector.

- Cofounder of Triodos Bank in Spain.

- Expert in Investment and Risk Analysis (Chairman of the Investment and Risk Committee of Triodos Bank in Spain).

- Member of the Management Committee as Deputy Director of Triodos Bank, being in charge of Business Banking Department and Commercial Net.

- Business Strategy consultant.

- Specialist in Sustainable Banking with a profound knowledge in organizations and companies that develop their activity in sectors such as Nature and Environment, Culture and Welfare,

and Social Business. - Mentor for CEOs and Social Entrepreneurs and he is an advisor for a Spanish Social Impact Fund.

- Business Angel & Investor in companies with high environmental & social impact.

Alejandra Goméz

Asset & Property Management

Alejandra Goméz

Asset & Property Management

Experience

- 20 years’ experience

- Expert in management costs

- Partner / QS Architect and PM

- Previously she worked in Remax Investment company, Ares Building Solutions, Cushman & Wakefield, EC-Harris (ARCADIS) as Project Manager, Tecnical consultant, Designer, Project Supervisor

and Due diligence Coordinator. - MBA in construction and real estate companies.

- BREEAM and Green Advisor associate LEED

- Member of the Board of Spain and construction group of RICS (Royal Institution of Chartered Surveyors )

- Founding partner of WIRES (Woman in Real Estate spain)

- She has a large experience with relevant clients as: BBVA, Caja Madrid, Santander, RBS, Citibank, Deutsche Bank, Hypo Real Estate Group, Morgan Stanley, GE Real Estate, ING Real

Estate, Nokia, Siemmens Networks, Heitman, Cognita, Neinver, etc

Camila Restrepo Reyes

ESG & Property Management

Camila Restrepo Reyes

ESG & Property Management

Experience

- More than 25 years of experience in the financial sector.

- Cofounder of Triodos Bank in Spain.

- Expert in Investment and Risk Analysis (Chairman of the Investment and Risk Committee of Triodos Bank in Spain).

- Member of the Management Committee as Deputy Director of Triodos Bank, being in charge of Business Banking Department and Commercial Net.

- Business Strategy consultant.

- Specialist in Sustainable Banking with a profound knowledge in organizations and companies that develop their activity in sectors such as Nature and Environment, Culture and Welfare,

and Social Business. - Mentor for CEOs and Social Entrepreneurs and he is an advisor for a Spanish Social Impact Fund.

- Business Angel & Investor in companies with high environmental & social impact.